Direct mail Test and Roll

Direct Mail A/B Test and Roll

This marketing plan template is an example of an A/B test strategy followed by a retest of the test winner and then a continuation. This series plan uses DM Multi.

Background and Assumptions

This direct marketer sells direct to consumer products a mix of products that they make and other commonly available products. They are introducing a new product and want to start with a price test to their house customer list.

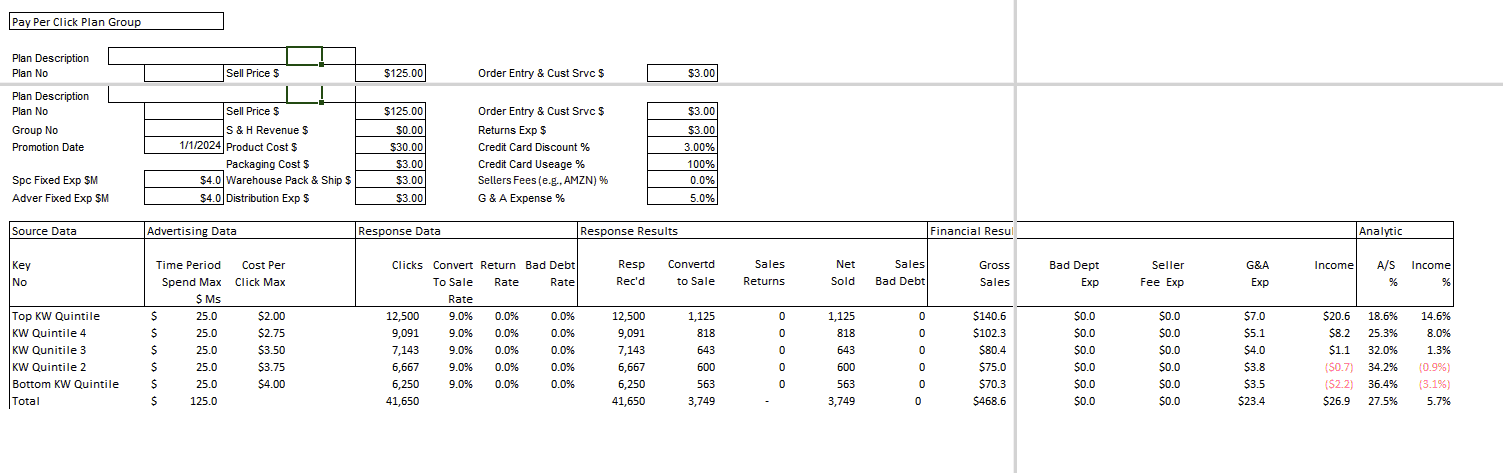

The active customer house list is 400,000 circulation. The marketer has extensive history of the house list response rates and uses RFM segmentation. So, they can estimate response rates for this new product with reasonable accuracy. The two prices being tested are $125 for the high price at a 1.75% response rate and $100 for the low price at a 2.0% response rate. The response rates are assumptions based on RFM history.

The product, operational, and transaction costs are the same for both prices. The conversion rate is the same at 100% as all order payments are by credit card. Return costs and percentage returns assumptions are the same for both prices.

Response Flow In Days are 15, which is the midpoint of the expected full range of 30 days for all responses. Convert to Sale Days are zero as all orders are approved in the credit card process. Pack & Ship Process Days are 2.

The advertising data costs are based on valid printing estimates from sources. The fixed cost of $5,000 advertising creative splits equally between each test side.

Part 1 Setting Up DM Multi Plan Descriptions

This section input gives general descriptions and the number of plans in the Multi. All the contents in lower table are calculated, not inputs.

Part 2 – Setting Up DM Multi Plan Details and Calculated Results

This section has data input above the horizontal bold line and calculations below.

Based on the MPP calculations, the high sell price test is the winner. It produces more sales and less Income loss. If this was the actual test results, there is no question the higher price at $125 is the winner. Therefore, this is the price the plan takes forward to a retest at that price only and continuation 1.

The Income on the retest and continuation improves from several factors:

- The product cost became less because production quantities increased. The marketer could have used the lower product cost in the test, but the first production run actually had higher cost and ultimate cost was not sure.

- Print and mail costs are lower now that circulations are higher.

- The advertising creative fixed costs are no longer applicable.

Both the retest and continuation assume the response rate will remain at 1.75%. This is possible because the marketers active list is 400,000 circulation and they are skilled at RFM segmentation. At some point in launching additional continuations, response will decrease.

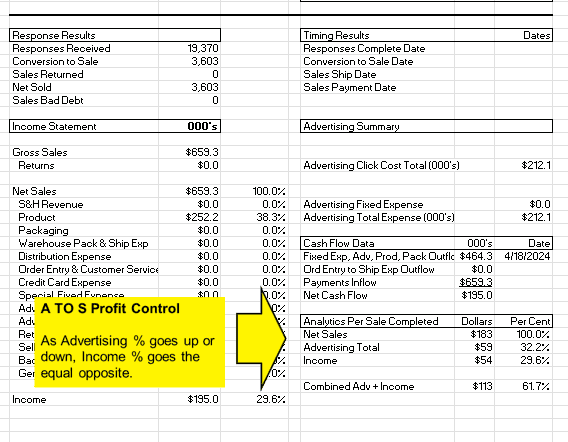

Part 3 – DM Mult Plan Calculated Combined Income Statement

This is the Income Statement of all plans combined.

There are no inputs to this section. Everything is calculated from previous inputs.