The Secret to Advertising Profit Control

Table of Contents:

Early Advertising Accountability

What is Advertising to Sales Ratio (A to S)?

Calculating Sales and Advertising

The Secret to Advertising Profit Control. The A to S Ratio

How to Use A to S to Control Profits

Customer Direct Mail and Email Profit Control

Conclusion

1. Early Advertising Accountability

The famous quote by John Wanamaker said, “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.“

This quote emphasized the challenge of accurately attributing advertising expense to sales and income (profit). John understood the importance of advertising. It brought in sales. But, in John’s time of the Nineteenth Century, measuring the results of advertising was difficult to impossible. Wanamaker’s was a department store with walk in customers not an internet marketer.

Today, marketers can target and measure sales and advertising in precise detail. And attribute a sale to an advertisement, keyword, or collection of customer contact points. Arguably, the most important factor in internet advertising is accurately tracking orders back to specific ads and segments. When you track sales sources it enables using profit and loss measures to guide advertising decisions.

2. What is Advertising to Sales Ratio (A to S)?

The Advertising to Sales Ratio (“A to S”) is the measurement of the advertising expense a company spends to generate sales. Companies compare themselves to peers in their industry by measuring A to S ratios. But very few companies report A to S clearly and publicly because competitors can use this key information.

The math to calculate A to S is simple. Divide Advertising Expense by Sales. The calculation is expressed or written as “A to S” or “A/S” or A/S %.

A different measurement in use in direct response marketing is “cost per order” which is the advertising in dollars to create a single sale. In the widely known NBC show Shark Tank the sharks use a similar expression “What is your customer acquisition cost?” They measure that number against the customer sale or the lifetime value of all sales. This is useful as a quick, easy indicator. But it is surprising how many shark pitchers looking for investment do not know it.

A different example of using advertising to control profit comes from public companies that periodically reduce advertising expense to improve weak quarterly earnings. They cut advertising and count on the momentum of sales not going down temporarily to report better profitability.

This post is not about accounting maneuvers. This post is to show you how you can use A to S as an everyday marketing tool to control sales and Income (profit).

3. Calculating Sales and Advertising

To accurately calculate the A to S ratio, it is important that you use the correct basis of Sales. Sales means Net Sales after deducting returns or refunds from Gross Sales.

When products sell as a series, like monthly shipment programs, over time, there is attrition caused by subscriber cancellations. It is important to always use Net Sales after cancellations. Moreover, if you include future sales projections of series subscriptions, it is critical to use a model that includes attrition. This is an important topic we will talk about in a future post.

How you categorize advertising expenses is also important. Expenses that are one-time, such as a logo design or new creative material that you will use multiple times, are fixed expenses. You should amortize fixed expenses across the higher sales of multiple campaigns combined. This is why in Marketing Profit Plans (MPP) you see “Advertising Fixed Costs” as a separate key driver expense. And why MPP profit analytics has two sections. One with and one without including fixed costs in the calculations.

Advertising expenses that are only used on a single ad or campaign, should be charged to that ad or campaign.

It is worth noting that direct mail campaigns can sometimes increase the overall expense of advertising but actually lower the A to S. This comes about when increasing the advertising distribution results in lower cost per thousand (cpm). A lower A to S can also lower the breakeven response rate. However, the total advertising expense will increase. The net effect can be a win-win of higher sales and income from a lower A to S percentage and a higher income percentage.

4. The Secret to Advertising Profit Control. The A to S Ratio

When you calculate all expenses except advertising and view advertising and income separately, you will see they have an inverse direct relationship. As one goes up, the other goes down by the exact same percentage. In other words, when advertising expense goes down from 40% to 25%, income will increase 15%.

This chart compares two scenarios to illustrate this critical point of A to S and Income.

| Scenario One | Scenario Two | ||||

| Low Response | High Response | ||||

| Product Sale Price | $ 100 | 100% | $ 100 | 100% | |

| Product Cost - All Expenses Except Advertising | $ 30 | 30% | $ 30 | 30% | |

| Orders | 2000 | 3000 | |||

| Net Sales | $ 200,000 | 100% | $ 300,000 | 100% | |

| All Costs Except Advertising | $ 60,000 | 30% | $ 90,000 | 30% | |

| Allowable for Advertising & Profit | $ 140,000 | 70% | $ 210,000 | 70% | |

| Advertising Cost | $ 80,000 | 40% | $ 80,000 | 27% | |

| Income (Profit) | $ 60,000 | 30% | $ 130,000 | 43% | |

In both these scenarios the product price and all costs are the same. Price is $100. All costs are for each sale is $30. The advertising spend is the same for both campaigns at $80,000. The number of orders in Scenario One is 2,000 and in Scenario Two it goes up to 3,000.

Scenario One

A direct mail campaign to 50,000 circulation with a response rate of 4% and $200,000 in sales. If product and all operating expenses are 30% of sales that is equal to $60,000. Advertising expense is $80,000. The income is then $60,000 or 30% of sales. The A to S is 40%, When you add Advertising and Income percents together, they equal 70%.

Scenario Two

Now, assume the same campaign has a higher response rate of 6% and $300,000 in sales. All product and operating expenses are 30% of sales, or $90,000. Advertising expenses are $80,000. But the Income now becomes $130,000. The A to S lowers to 27% and the Income rises to 43% . Again, the total of both is 70%. This increase in income in the second scenario is solely due to the lower A to S from the higher response rate.

So, the secret to controlling advertising profit is to control response and conversions rates that drive the A to S. It is that simple. Both A to S and Income Percentages are inverses. As one goes up, the other goes down by the same amount. The translation of the percentages to dollars is simply multiply the percentage times Net Sales.

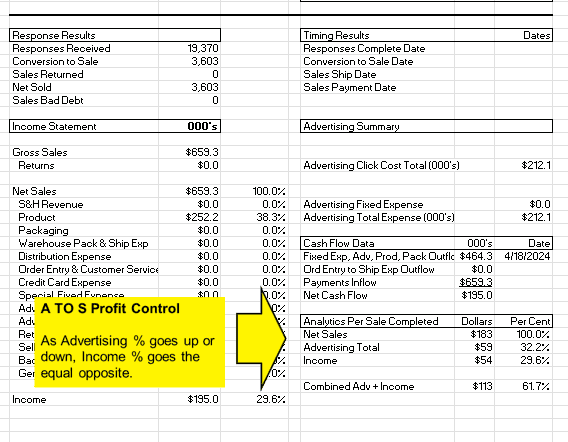

The MarPro Income Statement reports always show absolute amounts and percentages for both advertising expense and income.

To see the total of both together, MarPro plans show Analytics Per Sale Completed with Net Sales, Advertising Total, and Income. Below is the Combined Adv + Income total.

5. How to Use A to S to Control Profits

When you manage marketing planning with both numbers, the A to S and Income, new opportunities become available.

You can set different A to S and Income targets for different target groups. For example, prospecting for new customers usually requires higher advertising expense than selling to existing customers. Repeat sales from existing customers usually generate sales at a lower A to S and a higher income percentage.

You may decide new customer campaigns can accept higher A to S rates (and less Income) by lowering the required response rate. Or with a PPC campaign increase the bid amount and pay more for new customers. Or increase the reach with new keywords that may cost more, but “acquire” new customers otherwise not reachable.

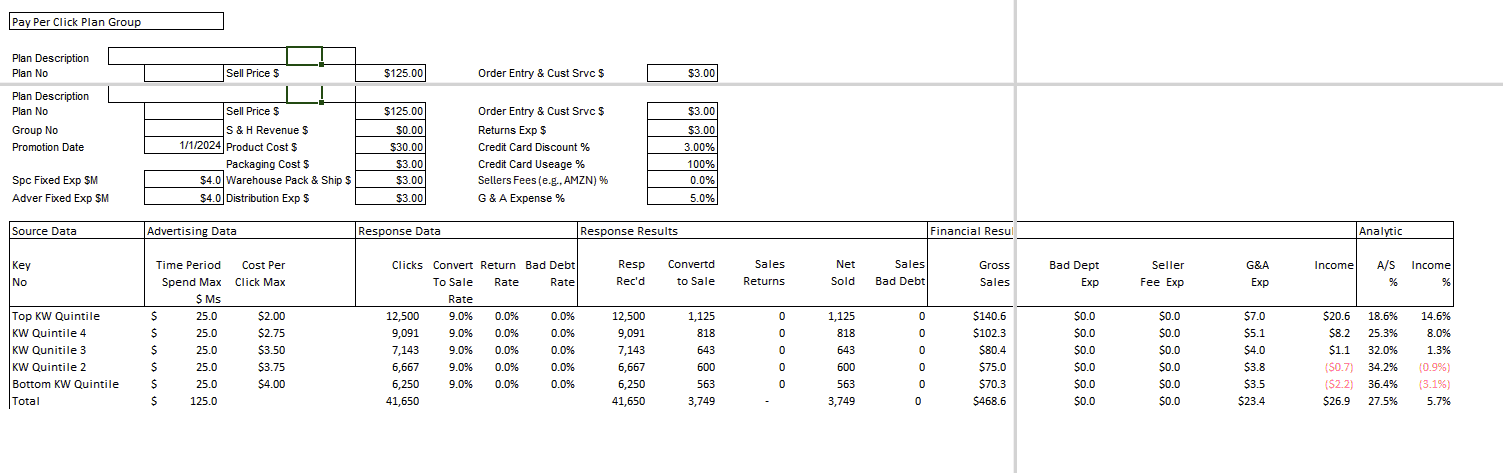

PPC Group Campaign Example

This example with a PPC Group campaign plan illustrates A to S control. The keywords being targeted are segmented into quintiles (groups of 1/5 each) ranked by Cost Per Click Maximum. The Time Period Spend Max is the same for all five groups. The keywords in Top KW Quintile have historically generated clicks and conversions at the lowest cost per click. The Cost Per Click Maximum increases as the keywords become less productive. All the keywords convert at the same ratio, 9.0%. (This is hypothetical and unusual as conversions usually vary by quality of the click source.)

The combined value of A to S and Income is 33.2%. Note that G&A expense is 5% of Sales.

The MarPro strategy of this plan is to accept an Income loss on the lower two quintiles for several reasons. The additional orders and sales from new customers is desired because later sales from the new customers will make up for the small initial losses. Additionally, if G&A is left out of the lower quintiles profit calculation, the G&A amount is greater than the loss. And the new orders from the lower quintiles can be processed without real G&A expense.

Using A to S together with Income, you see the bottom-line impact of the bid amounts. You may even choose to acquire new customers at breakeven. Or to go even further and not include general & administrative expense in your calculations. You can justify this if G&A does not change with slight changes in sales volume.

Within customer direct mail or email campaigns, you may choose to increase income and lower A to S by limiting mail to customer segments that respond at higher rates.

By managing marketing with a view on A to S and Income, you can create a blended income level from new customer acquisition and profitable current customers that gives you a “win-win” situation of new customer growth and overall profitabilit

6. Direct Mail and Email Profit Control

Email and direct mail to customers provide special opportunities to control A to S and income.

This comes from scoring customers and ranking them based on Recency, Frequency, and Monetary (RFM) values from previous sales. After scoring, you can segment customers into groups by response rates (likelihood to order) A to S ratios and resulting Net Sales and Income.

MarPro DM Group has the same layout structure as PPC Group, which allows up to 199 different segments to be planned.

7. Conclusion

Advertising to Sales ratios and Income ratios are important tools to achieve effective marketing results. By understanding and using these ratios, businesses can make informed decisions regarding advertising expenditures, maximizing marketing results, and work towards controlling profitability and driving sales.

We designed Marketing-Profit-Plans templates specifically to accomplish this at levels from overall business planning to campaign planning to individual segment key codes.